When the World Gold Council released Touched by Gold, its intimate documentary on Sir Elton John, it offered more than a portrait of a musical legend. It opened a window into how certain materials, gold, silver, platinum, become part of our collective memory, our identity and, increasingly, our financial architecture. (Touched by Gold: Elton John)

For The Legacy Custodians, the film is a rare intersection of culture and capital: the story of one artist’s life “touched by gold,” arriving at a time when global families, central banks and economists are re-evaluating the role of precious metals in portfolios and in the international monetary system.

Sir Elton John has always understood that performance is as much visual as musical. From sequinned jumpsuits and feathered capes to spectacular crystal-studded headpieces and metallic suits, his stage costumes turned concerts into immersive theatre.

Touched by Gold leans into this visual language of opulence and playfulness. One of the most memorable details is the fabulous jewellery piece fashioned from Sir John’s own knee caps, a mischievous, almost surreal object that perfectly captures his ability to turn the personal into pop mythology. It is both a literal and metaphorical embodiment of value: the body transformed into art, art transformed into legacy.

For those of us fortunate enough to have lived through his era, the documentary is a reminder of what his music, glamour and style have meant across generations, and how enduring symbols can outlive the moment that created them, almost like building a culture or tradition.

If Touched by Gold explores the emotional and cultural resonance of gold, India and China show what happens when that symbolism is scaled to the level of households and nations.

India: World Gold Council research estimates Indian households hold 23,000–25,000 tonnes of gold – a stock worth well over USD 2 trillion at recent prices, and multiple times the country’s official reserves. (Source: World Gold Council) This is not speculative capital; it is intergenerational security embedded in weddings, heirlooms and family balance sheets.

China: In China, gold remains central to life-cycle rituals and is increasingly part of younger consumers’ financial and identity choices – from zodiac-themed 24-carat jewellery to investment bars and coins. (Source: World Gold Council)

Even as high prices have moderated jewellery volumes in both markets, total spending and bar-and-coin investment remain resilient.

(Source: World Gold Council) Put simply, Indian and Chinese families are not trading in and out of gold; they are accumulating it as a long-duration store of trust.

At the sovereign level, a similar story is unfolding.

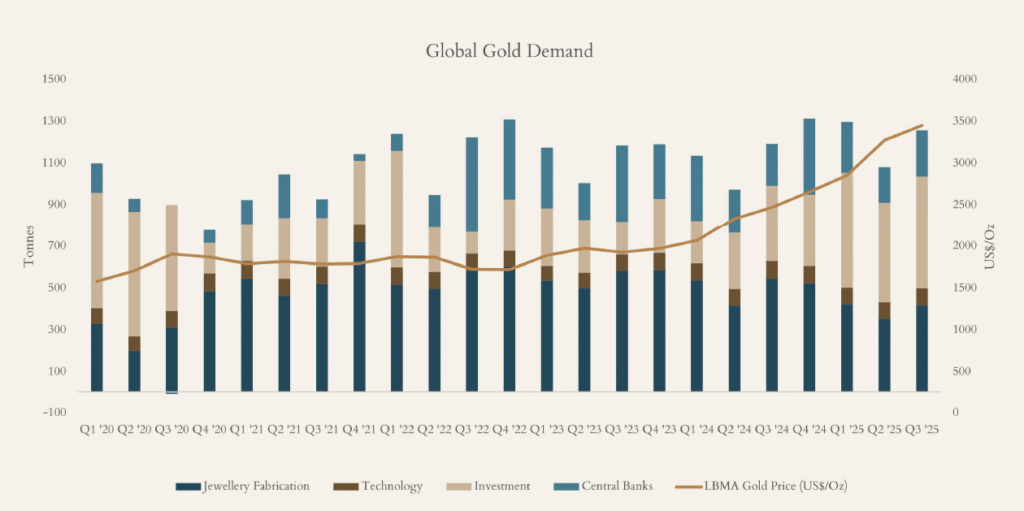

According to the World Gold Council, central banks bought more than 1,000 tonnes of gold per year in 2022 and 2023 and 1,045 tonnes of gold in 2024 – the strongest official-sector accumulation in decades.

(Source: World Gold Council – Central Bank Gold Statistics World Gold Council).

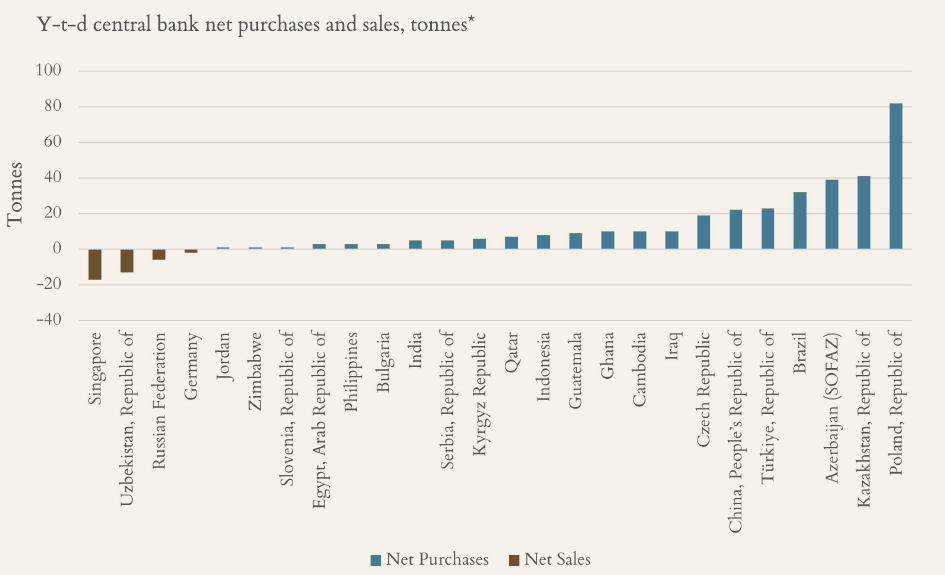

This trend has continued, with:

- Central banks are adding hundreds of tonnes in 2024–25, even as prices hit successive record highs. Central banks bought a net 53t in October, 36% higher m/m and the largest monthly net demand YTD (Source: World Gold Council).

- The Reserve Bank of India is steadily increasing its gold reserves, now approaching 900 tonnes, as part of broader efforts to diversify away from pure fiat exposure. (The Economic Times)

Economists and strategists have started to frame this as more than a cyclical trade:

- Zoltan Pozsar describes the shift as a move from the Bretton Woods era “backed by gold bullion,” to Bretton Woods II backed by bank liabilities, towards a Bretton Woods III regime “backed by outside money” – real assets such as commodities and gold.

(Source: Bloomberg Podcast: This Is Zoltan Pozsar’s Vision For Bretton Woods III)(static.bullionstar.com)

- The World Bank notes that record central-bank buying has pushed gold’s share of global demand to nearly 25% in 2024, coinciding with heightened geopolitical tension and a weaker US dollar.

(Source: World Bank Blogs)

Taken together, this looks less like tactical hedging and more like a structural re-rating of gold as neutral reserve

collateral in a more fragmented, multipolar world.

For families and institutions focused on long-term capital preservation, it’s important not to see gold in isolation.

Academic work and practitioner research over the past decade show that gold, silver, platinum and palladium have all, at different times and in different markets, acted as hedges or safe havens against equity and bond market stress. (Source: ScienceDirect)

However, the roles of silver and platinum are evolving:

- Silver

- Plays a “critical role” in solar panels, EVs and power electronics, making it a key metal for the clean-energy transition. (Source: Sprott)

- Has recently outperformed gold in some risk-off episodes, though economists and strategists caution that its smaller, more industrially-driven market makes it more volatile than gold. (Source: Reuters)

- Platinum

- Recently outperformed gold in some risk-off episodes, though economists and strategists caution that its smaller, more industrially-driven market makes it more volatile than gold.

Heraeus Precious Metals (is among the world’s largest refiners, traders, and processors of precious metals — covering gold, silver, platinum group metals and other precious metals) recently released its 2026 Outlook (Source: Heraeus Precious Metals – 2026 Outlook), offering a detailed perspective on the trajectory of major precious metals. The firm anticipates that gold may consolidate in the near term before resuming an upward trend, with price expectations in the $3,750–$5,000 per ounce range. While prices may continue to climb in the near term, analysts anticipate that such a sharp upswing will likely be followed by a reset and consolidation phase in early 2026, paving the way for the next leg of sustained growth.

Silver is expected to remain highly volatile, reflecting uneven demand across key industrial segments, with a projected trading band of $43–$62 per ounce. Though they state that, Silver is expected to remain a more volatile investment than gold. If the rally in gold resumes, then silver is likely to follow.

For Platinum, Heraeus forecasts that the market is likely to stay in deficit, albeit a narrower one compared to recent years, supporting an estimated price range of $1,300–$1,800 per ounce.

Conversely, Palladium may face continued pressure, with the surplus potentially widening as automotive sector demand weakens, placing its outlook around $950–$1,500 per ounce.

The question one should ask is whether silver and platinum could truly join gold as safe-haven peers.

For Legacy Custodians, the lesson from Touched by Gold is twofold:

- Narratives matter: Gold is not only a line item in a balance sheet; it is a cultural and psychological anchor. In India and China, its role in wedding gifts, heirlooms and rituals translates directly into balance-sheet resilience. For a global family, understanding these narratives helps explain why certain assets remain “never-sell” holdings, regardless of price cycles.

- Architecture matters even more: Central banks diversifying into gold, households in Asia deepening their holdings, and silver and platinum becoming critical to the energy transition all point to the same underlying story: a slow re-weighting of real assets relative to purely financial claims.

For long-horizon Custodians, the task is not to chase the latest price move, but to:

- Clarify the role of precious metals in the family’s strategic asset allocation.

- Distinguish between reserve-like holdings (outside money held for sovereignty and resilience) and tactical exposures (vehicles usedfor opportunistic return).

- Integrate metals policy with broader views on currency risk, geopolitical exposure and the energy transition.

The answers will differ by family, jurisdiction and philosophy. But ignoring this shift altogether may, increasingly, no longer be a neutral decision.