Why Single Family Offices in India Operate at a Lower Cost Structure Than Their Global Counterparts

One of the most common questions I receive from families coming into liquidity is: “Should we set up our own family office?” While it seems like a simple question, the answer is rarely straightforward. The decision requires a thoughtful discovery process, beginning with a clear understanding of why a family office is needed in the first place.

Many families consider establishing a family office primarily for confidentiality reasons and due to a trust deficit within the wealth management industry. However, instead of first identifying their actual needs, they often focus on the financial threshold required to set up an office. A more structured approach would involve assessing both short-term (5–7 years) and long-term, multi-generational requirements.

A family office’s role extends beyond wealth management; it is an administrator that enhances the family’s overall quality of life and safeguards its legacy. Families must evaluate needs across key areas such as legacy planning, succession, compliance, governance, operational business support, and stakeholder communication, including between the Family Board, operating companies, and external advisors, in addition to overseeing liquid wealth. Once these requirements are mapped out, an appropriate organizational structure and team can be considered.

The Cost-Benefit Analysis of a Family Office

Another frequently asked question is: “What is the minimum financial asset size required to justify a single-family office?” While some families establish an office with as little as $25 million in AUM, their primary focus is often on managing operating businesses or lifestyle needs, rather than liquid assets. In such cases, the Family Principal typically leads the office, with family members and key finance personnel taking on dual roles—acting as both business managers and investment analysts.

The challenge, however, lies in attracting high-calibre talent. Hiring experienced professionals comes at a cost, often prompting families to reconsider whether setting up their own office is the right decision.

A key factor in this decision is whether the family office will operate as a cost centre or a profit centre. If structured as a profit centre, its investment management capabilities must be rigorously assessed, including benchmarking performance against defined family objectives. Some family offices attempt to manage investments internally, appointing a family member as Chief Investment Officer (CIO) or assigning the Group CFO (who also oversees operating businesses) to this role. However, given the increasing complexity of financial markets, experienced professionals with a deep understanding of market cycles are essential.

How Indian Family Offices Compare Globally

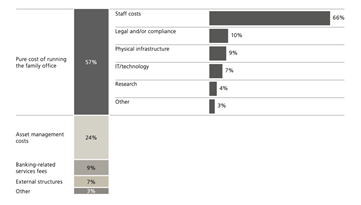

The UBS Family Office Report 2024, based on a global survey of 320 family offices (with an average net worth of US$2.6 billion and assets under management of USD$1.3 billion), highlights details of the cost structures:

– Globally, less than 20% of family offices operate with three or fewer employees, which is insufficient to handle investment management, accounting, administration, and philanthropic objectives.

– It was interesting to see that the survey highlighted that in 72% of the Family Office there was at least one Family Member who was an employee of the Family office, which also means that typically Family Members do not draw market salaries for the job they do.

– The average operating cost of a well-staffed global family office (6–8 professionals) exceeds $1.5 million per year.

Family office expenses are spread across various categories, with staff salaries forming the largest cost component. Other significant expenses include structuring, technology, operations, legal & compliance, and administrative costs. The UBS Family Office Report 2024 provides insightful data on cost distribution, offering a useful benchmark for domestic family offices to compare and evaluate their spending patterns.

In contrast, Indian families face unique constraints that lead them to operate at a lower cost structure:

1. Talent Acquisition Challenges – Due to cost considerations, many Indian family offices avoid hiring expensive professionals, which limits their in-house expertise.

2. Reliance on External Market Intelligence – Many teams lack deep asset management experience and depend on distributors or asset management firms for insights, often leading to portfolios influenced by industry trends rather than family-specific objectives.

3. Cost Structure Breakdown – Major expenses include staff salaries, structuring, technology, operations, legal & compliance, and administration. Given the high cost of maintaining a full-scale team, families increasingly outsource key functions to access specialized expertise while keeping costs manageable.

The Case for Outsourcing

Running a family office is an expensive endeavour, making outsourcing an attractive alternative. Since family office operations are not always intensive or transaction-heavy, there are periods of low activity, making full-time staffing less efficient. By outsourcing functions such as compliance, accounting, and investment oversight / research, families can access top-tier expertise while keeping fixed costs lower.

Ultimately, the decision to establish a family office should be guided by a clear needs assessment, a realistic cost analysis, and an understanding of the long-term value it can provide.